This website uses cookies and is meant for marketing purposes only.

On Wednesday Wall Street Futures, Gold, and UST/US bond slid, while USD jumped after hotter than expected US core CPI/inflation report. The market is now implying -75 or even -50 bps rate cuts from September or October’24. Before the inflation report Wednesday, the market was expecting June-July mostly and September partially; but began to imply a higher probability for the Sep’24 rate cut against June-July. The US10Y bond yield surged to +4.55% and approaching the Fed’s red line zone of 4.75-5.00%. Wall Street Futures were also under stress as the U.S. warned about an imminent missile/drone attack by Iran on Israel. Gold and Oil surged.

On Thursday, the focus of the market was on US core PPI data for March. The market usually tries to assume the core PCE inflation trend/sequential & annual rate through core CPI and core PPI data which is published around mid-month against core PCE at the month's end. In that sense, core PCE inflation data, which the Fed officially gives priority to gauze the trend & outlook of underlying inflation for any policy action is a lagging indicator. Officially, as per the latest Congressional/Senate testimony, the US Congress has given the Fed price stability target of +2% for headline inflation (total CPI, not PCE).

In his recent Congressional testimony, Fed Chair Powell acknowledged that headline/total CPI 2% consistently is Fed’s price target while facing an ‘angry’ Senator as the average price levels for various goods & services affect the daily life of ordinary Americans (vote box for any party) is still substantially higher by over +20% than pre-COVID levels in the election year, despite political blame game of Bidenflation, Putinflation, Corporate greedflation and also shrinkflation. As per the 2% headline CPI, there should be a 10% price increase in general over 5 years, not 20%. Also, real wage growth is now almost flat.

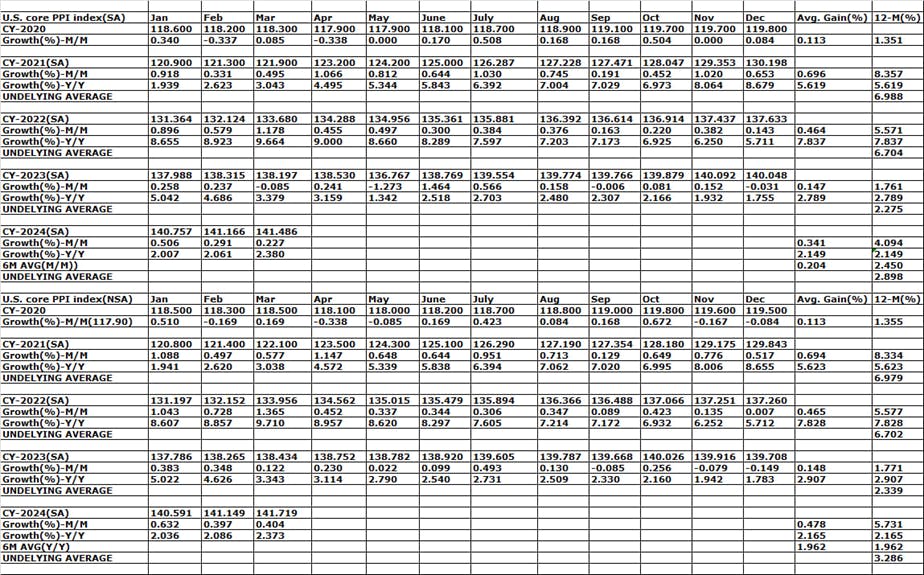

On Thursday, the BLS flash data (NSA) showed annual (y/y) U.S. core PPI (w/o food & energy) surged +2.4% in Mar’24, from +2.1% sequentially and above the market consensus of +2.3%.

On a sequential (m/m) basis (SA), the U.S. core PPI eased to +0.2% in Mar’24 from +0.3% in Feb’24 and is in line with the market expectations of +0.2%.

Overall, the 2024 (YTD) average of core PPI is now around +2.2% against +2.9% in 2023, +7.8% in 2022, and a 6M rolling average of +2.0%.

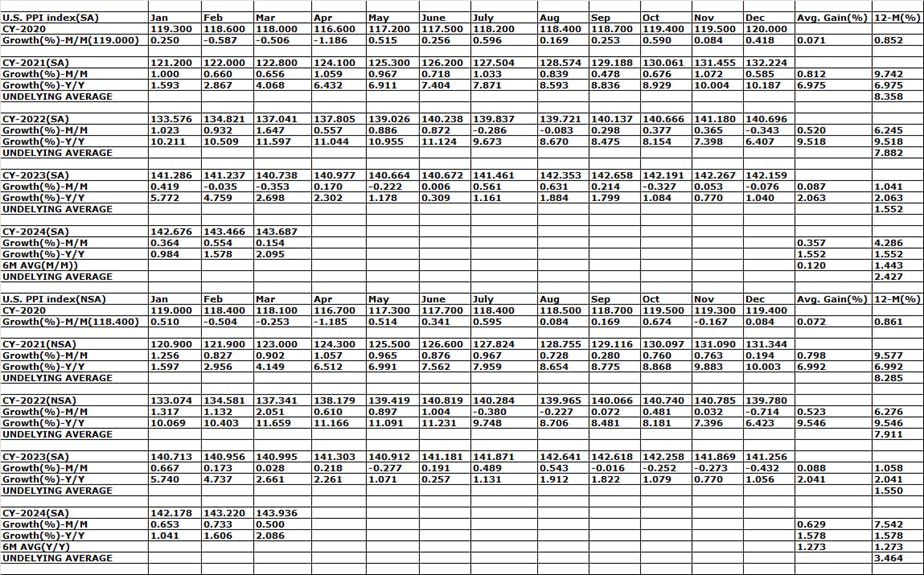

On Thursday, the BLS data (NSA) also shows U.S. annual (y/y) total PPI surged to +2.1% in Mar’24 from +1.6% reading sequentially, below market expectations of +2.2% and the sharpest increase since Apr’23.

On a sequential (m/m) basis, the U.S. PPI eased +0.2% in Mar’24, from a +0.6% increase in the previous month, above market forecasts of 0.3% after the sharpest increase in the last 6 months last month (since Aug’23).

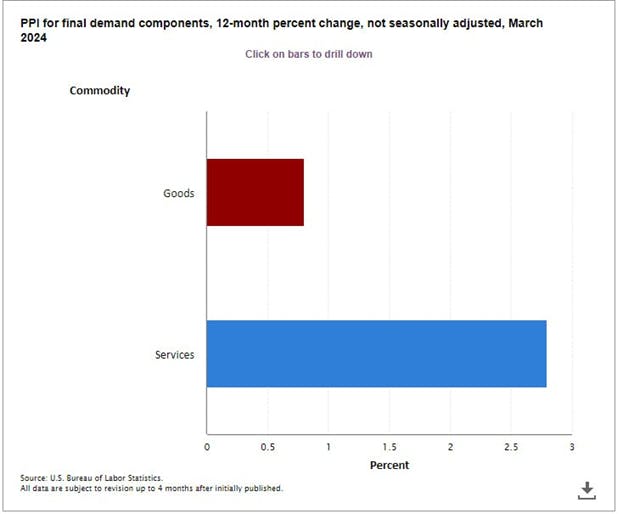

In Mar’24, prices for services rose +0.3%, the same as in February, led by gains in securities brokerage, dealing, investment advice, and related services (3.1%). Cost also moved higher for professional and commercial equipment wholesaling; airline passenger services; investment banking; deposit services (partial); and computer hardware, software, and supplies retailing. On the other hand, goods cost went down 0.1%, following a +1.2% rise in the previous month, as gasoline dropped -3.6% along with chicken eggs, carbon steel scrap, jet fuel, and fresh fruits and melons.

Also, fine prints of BLS flash data show US core personal consumption for the PPI index, equivalent to core PCE increased around +0.2% in Mar’24 after a +0.4% advance in the previous month. Meanwhile, the sequential rate of core CPI was also around +0.4% in March. If this trend/sequential rate of around 0.3% holds in Mar’24 sequential core PCE data, the annual core PCE inflation would be around 2.8% in Mar’24 unchanged from the +2.8% annual rate and may also put a question mark on the present trend of disinflation.

But overall, the US core inflation is cooling and by Dec’24, the average reading may be around +3.0%. US PPI increased in March from a year earlier by the most in 11 months, though certain categories that feed into the Fed’s preferred inflation gauge PCE were more muted. Subsequently, Wall Street Futures and Gold UST surged. Also, the combination of lower PPI and higher CPI may indicate more pricing power in the hands of producers (service providers and manufacturers) and higher EBITDA/operating profit (greedflation).

On Thursday, Boston Fed’s President Collins said:

· It may take more time than previously thought to gain the confidence to begin easing policy, possibly warranting fewer rate reductions this year

· Recent inflation data hasn't the changed view about the outlook

· The economic strength may mean that Fed policy is not as restrictive as we thought

· Disinflation is likely to continue to be uneven

· May take longer to get inflation back to 2%

· The economy is resilient in the face of the Fed rate policy

· I expect inflation to continue to moderate

· Fed policy is well-positioned for the current economy

· I expect inflation to continue to moderate

· Recent data argue against the imminent need to change rates

· Economic uncertainty is elevated

· Wage growth is consistent with the path back to 2% inflation

· The first quarter CPI figures were higher than I had hoped

· It's too early to make sense of the recent rise in productivity.

· Short-term inflation expectations are now consistent with the 2% inflation goal

· I expect inflation to continue to moderate

· Economic strength may auger fewer rate cuts

· A strong job market reduces the urgency of rate cut need

· Recent inflation data hasn't the changed view about the outlook

· Disinflation is likely to continue to be uneven

· Fed policy is well-positioned for the current economy

On Thursday, Fed’s Williams said:

· No Need To Change MonPol ‘In Very Near Term’, Recent Inflation Setbacks Are Not A Surprise To Fed

· Core services ex-housing inflation is falling faster than expected

· Recent inflation setbacks are not a surprise to the Fed

· Shelter inflation is slower to come down than expected

· Fed policy is making progress in working out economic imbalances

· A Fed rate hike is not part of the baseline view for the outlook

· Eventually, we will need to cut rates

· Supply shortages did not move inflation data as much

· I don't know exactly what lies ahead for monetary policy

· The economy is in a good place right now

· Monetary policy is well-positioned to achieve the Fed's goals

· I don't see a financial stability crisis in commercial real estate

· Recent inflation data has been disappointing

· It is better to focus on the trend for inflation

· The outlook is uncertain and the FOMC must be data-dependent

· Monetary policy is well-positioned to achieve the Fed's goals

· I don't see a financial stability crisis in commercial real estate (CRE)

· Evidence suggests reserve levels remain abundant

· Slowing balance sheet runoff does not mean ending the process

· Housing is very strong but doesn’t see signs of a bubble

· Expects US GDP to hit 2% this year

· We remain focused on getting inflation back to 2%

· Expects inflation to settle back to 2% next year

· I expect the unemployment rate to rise to 4% this year

· Inflation to stand at 2.25-2.5% this year

· Risks between inflation, unemployment moving into better balance

· The Fed has made ‘considerable progress’ on lowering inflation

· Inflation moving toward 2%, I expect further bumps

· Commercial real estate is an area of concern, that will take time to resolve

· I see a great deal of uncertainty over the economy

· The US economy has benefited from positive supply shocks

· Inflation fell faster than expected last year

· The process of lower inflation has hit some bumps

On Thursday, Fed’s Barkin said:

· It's smart to take time, to see if inflation slows

· Supply shortages do not move inflation data as much

· The latest inflation data did not increase confidence that disinflation is spreading in the economy

· The latest inflation data looks like it did at the end of 2023, with goods prices falling, shelter moving sideways and services increasing

· The Fed is not yet where we want to be on inflation, though it is headed in the right direction over a longer time frame

· We're not where we need to be, but headed in the right direction

· Inflation data raise the question if we are seeing a shift

· The labor market strength makes the case that the US isn't in recession

· Previous Fed tightening will slow the economy further

· I want to see broader disinflation, not just in goods

On Thursday, IMF's Managing Director Georgieva said:

· The US economy has been successful because it is more innovative, and labor markets have been holding well

· US growth helps the global economy, but higher US rates are "not great news" for the rest of the world

· If higher US rates continue for a long time, it could become a worry

· I think the US Fed is acting prudently

· The long-term strong dollar could become a financial worry

· China must take on a new economic course because what has worked in the past cannot be sustained in the future

· China has taken some measures to address property sector problems, but it can do more

· If China commits to the recommended reforms, it could boost output by 20% over the next years

· Central banks must calibrate rate decisions to incoming data, resist calls for early rate cuts where necessary

The 6M rolling average of US core inflation (PCE+CPI) is now around +3.5%. Fed may cut 75 bps in H2CY24 if the 6M rolling average of core inflation (PCE+CPI) indeed eased further to +3.0% by H1CY24.

As per Taylor’s rule, for the US:

Recommended policy repo rate (I) = A+B+(C-D)*(E-B)

=1.50+2.00+ (2.60-2.00)*(4.50.00-2.00) =1.00+2+ (0.60*2.50) = 3.00+1.50=4.50% (By Dec’24)

Here:

A=desired real interest rate=1.50; B= inflation target =2.00; C= Actual real GDP growth rate for CY23=2.6; D= Real GDP growth rate target/potential=2.00; E= average core CPI+PCE inflation for CY23=4.50

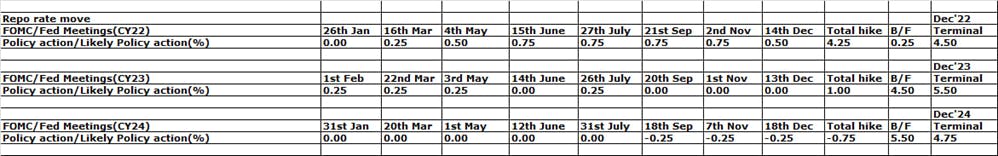

The Fed may go for -75 bps rate cuts in September, November, and December’24. By 18th September (Fed MPC date), the Fed will have complete data for core inflation and also unemployment/real GDP data for H1CY24 and also Aug/July’24 to have the required ‘higher confidence’ to go for rate cuts. Fed may bring down the repo rate to +4.75% by Dec’24 from present +5.50%.

Fed may announce a plan for QT tapering/closing in the May meeting and should have closed the same before going for rate cuts in H2CY24. Fed, the world’s most important central bank may not continue QT (even at a reduced pace) and go for rate cuts at the same time as QT, and rate cuts are contradictory, although Fed/Powell kept the option open, at least theoretically. Thus assuming an absurd/bizarre phenomenon, the Fed may go for -75 bps rate cuts in H2CY24, most probably from Sep’24 after deciding about the possible B/S size to ensure money market stability

Looking ahead, the Fed may keep B/S size around $6.55T, around pre-COVID levels to ensure financial/Wall Street stability along with Main Street stability (price stability and employment stability). Fed’s B/S size is presently around $7.50T (Mar’24 end). Depending upon the actual rate/reaction in the repo/funding market, the Fed may taper the QT from the present $0.095T/M to 0.050-0.075T/M for 20-12 months from May’24;i.e. Fed may end the QT by May’25-Dec’25 at B/S size around $6.55T. This is lower than the earlier market estimate of $7.00T and thus should be seen as more hawkish. Also, rate cuts along with QT (even with slower pace/tapering) should be less hawkish.

Ahead of the Nov’23 U.S. Presidential election, White House/Biden/Fed/Powell is more concerned about elevated inflation rather than the labor market; prices of essential goods & services are still significantly higher (around +20%) than pre-COVID levels, which is creating some incumbency wave (dissatisfaction) among general voters against Biden admin (Democrats).

Thus Fed is now giving more priority to price stability than employment (which is still hovering below the 4% red line) and is not ready to cut rates early as it may again cause higher inflation just ahead of the November election. Fed may hike only from Septenber’24, which will ensure no inflation spike just ahead of the Nov’24 election (as any rate action usually takes 6-12 months to transmit in the real economy), while boosting up both Wall Street and also Main Street (investors/traders/voters). Fed hiked rate last on 26th July’23 and may continue to be on hold till at least July’24; i.e. around 12 months for full transmission of its +5.25% cumulative rate hikes effect into the real economy.

Overall, the Fed’s mandate is to ensure price stability (2% core inflation), and maximum employment (below 4% unemployment rate) along with financial/Wall Street stability as well as lower borrowing costs for the government. As the US is now paying almost 15% of its tax revenue as interest on debt, the Fed will now not allow the 10Y US bond yield above 4.50-5.00% at any cost.

Bottom line:

Fed may continue QT (even at a slower pace) and go for a rate cut cycle at the same time despite these two policy actions being contradictory. Thus the Fed may go for rate cuts of -75 bps cumulatively in September, November, and December’24 for +4.75% repo rates from the present +5.50%. Fed may bring down further its B/S size from present around $7.5T to $6.55T through QT tapering by May-Dec’25 to keep minimum/ample liquidity for the US funding/money market and also to prepare itself for the next cycle of QE, whatever may be the recession excuse.

The market is now expecting 5 rate cuts (-125 bps) in 2025 against the Fed’s official 2-3 rate cuts; the Fed may go for 4 rate cuts in 2025 if Trump comes to power/White House or even under Biden. Fed’s mandate is now 2% price stability (core inflation), below 4% unemployment rate, and below 4.75-5.00% US 10Y bond yield to ensure lower borrowing costs for the government and overall financial stability. Fed, as well as ECB, BOE, and BOC, are now struggling to keep bond yield and inflation at their preferred range despite non-stop jawboning; perhaps they are now talking too much and thus FX market is not influenced by them significantly, moving in a narrow range. The BOJ is now trying to talk down the USDJPY desperately, presently hovering around 152 levels, causing higher imported inflation and higher cost of living back home.

Market impact:

On Thursday, Wall Street Futures, Gold, and UST/US bond surged, while USD slumped on hopes of less hawkish Fed rate action in the coming days after softer than expected US PPI. But overall market the market is now implying -75 or even -50 bps rate cuts from September or October’24. Wall Street Futures were also under stress as the U.S. warned about an imminent missile/drone attack by Iran on Israel; gold and oil surged. Additionally, Gold was also boosted by increasing geopolitical tension between China and Taiwan. All the metals including industrial metal Silver and Gold to some extent are also boosting hopes of an early economic recovery by China (worst may be over) and increasing optimism/usage in AI Chips.

On Thursday, Wall Street was boosted by techs (AI chips optimism), communication services, consumer discretionary, industrials, and real estate, while dragged by banks & financials (ahead of big banks' report cards), healthcare, consumer staples, utilities, energy and materials to some extent. Script-wise, Wall Street was boosted by Apple, Nike, Amazon, Amgen, Intel, Microsoft and CISCO, while dragged by United Health, J&J, Home Depot, P&G, Walmart and Boeing.

Technical trading levels: DJ-30, NQ-100 Future, and Gold

Whatever may be the narrative, technically Dow Future (38750), now has to sustain over 38550 for a rebound to 39500-40000/40200-40600/40700 to 42600 levels in the coming days; otherwise, sustaining below 38500-38350/38295*, may again fall to 37950/37700-37600 and 37050-35550 levels in the coming days.

Similarly, NQ-100 Future (18165) now has to sustain over 18000 for a rebound to 18500-18750 and 19000/19200-19450/19775 and 20000/20200 in the coming days; otherwise, sustaining below 18000, NQ-100 may gain or fall to around 17800/17575*-17150/16850 and 16650/16490-15900/15700 in the coming days.

Also, technically Gold (XAU/USD: 2390) now has to sustain over 2415 for any further rally to 2425/2455-2475/2500; otherwise sustaining below 2410-2405, may again fall to 2375/2350 and 2320/2315-2305/2300 and 2290/2270-22245/2240, and 2220/2210-2200/2195-2190/2180 and 2175/2145*, and further to 2120/2110-2100/2080-2060/2039 and 2020/2010-2000-1995/1985-1975 and even 1940 may be on the card.

The materials contained on this document are not made by iFOREX but by an independent third party and should not in any way be construed, either explicitly or implicitly, directly or indirectly, as investment advice, recommendation or suggestion of an investment strategy with respect to a financial instrument, in any manner whatsoever. Any indication of past performance or simulated past performance included in this document is not a reliable indicator of future results. For the full disclaimer click here.

Join iFOREX to get an education package and start taking advantage of market opportunities.