This website uses cookies and is meant for marketing purposes only.

From the Incas to King Midas, from dictators to notorious pirates - silver and gold have been considered valuable by humans for thousands of years. The first recorded use of gold in coins was as far back as 600 BC, and over the years these precious metals’ importance as investments only intensified. In this article, we will explain how you can invest in the price of silver and gold in the form of CFD trading and discuss some of the factors that affect the market. Ready? Let’s get started.

In the past, if you wanted to invest in precious metals, you had to actually buy and store them. If you wanted to make a large investment, you needed a huge safe for secure storage. Today though, many people from all over the world invest in the price of silver and gold in the form of CFDs, whenever and wherever they choose. How does this work? Well, CFD stands for Contract for Difference, and this form of trading enables you to invest in the price of a specific precious metal without actually owning it. In CFD trading you buy ‘contracts’. For example, when you trade gold CFDs, one ‘contract’ is the price of one ounce of Gold.

Remember: When you trade gold or silver at iFOREX in the form of CFDs, you can take advantage of any change in price – up or down. If you think that the price of the precious metal will go up, choose ‘Buy’ (long position). If you think the price will go down, choose ‘Sell’ (short trading).

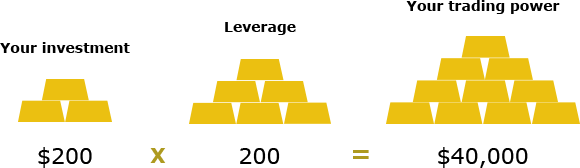

This is a good time to discuss leverage – an incredible tool that enables you to maximize your investment potential, by effectively boosting your trading power. Confused? Here’s a quick example. For gold and silver the maximum leverage is 200:1, so if you were to invest $200 in gold, with a leverage of 200:1, your trading power will be $40,000. Still confused? Take a look at the diagram below:

Remember: While leverage enhances your trading power, it also increases risk, and should be used carefully. Take your time getting acquainted with this powerful tool and gain a better understanding of its advantages and disadvantages.

Many factors influence the price of gold and silver. As with any other tradable instrument, supply and demand are at the heart of the market, but several factors could be involved. Here are a few possible examples:

It is important to remember that, unlike other commodities, gold is often used by central banks to diversify reserves. Therefore, when a large country such as China decides to expand its gold reserves, it could potentially impact the market.

The price of precious metals fluctuates constantly, moved by the factors we’ve mentioned above and many others. For many years though, gold was an essential part of the global monetary system when the dollar was pegged to it as part of the ‘Bretton Woods system’ in 1944. The aim of the Bretton Woods system was to govern monetary relations among separate nation-states: The United States, Canada, Australia, Japan and Western Europe. In August 1971, the United States unilaterally unpegged the Dollar from gold, effectively ending the Bretton Woods system, making the Dollar a free-floating currency.

At iFOREX, you can invest in a wide variety of CFD instruments including shares, indices, currencies and commodities. So, what is the difference between precious metal trading and other CFD assets? Here’s a quick comparison between gold and silver vs. share CFDs.

Trading gold and silver CFDs

Share CFDs

Want to take a look at our other tradable instruments? Visit our Trading Conditions page.

Today, gold is traded all over the world according to the intra-day ‘spot’ price, which is derived from over-the-counter gold-trading markets worldwide. The code for this gold price is XAU, and that’s the same rate used by iFOREX when you trade gold in the form of CFDs.

Join iFOREX to get an education package and start taking advantage of market opportunities.