This website uses cookies and is meant for marketing purposes only.

Oil surged almost +15% in Q1CY24 on signs of gradual rebalancing amid extended/permanent OPEC+ production cut (voluntary/involuntary), demand recovery from China, and lingering geopolitical tension ranging from Gaza war/Yellow Sea route targeting by Houthi rebels (Iran’s proxy) and Russia-Ukraine war, where Ukraine recently droned some Russian refineries. Oil was further boosted after Israel destroyed Iran’s embassy/consulate in Damascus (Syria) and subsequent ‘friendly’ retaliation by Iran with hundreds of drones and missiles (after intimating Oman/US/Israel well in advance about relatively harmless abandoned Israeli military targets/coordinates). The whole world led by West/NATO/GT is now ‘trying’ to ‘pacify’ Israel and also Iran not to engage in the vicious cycle of an all-out real war, as it may start the much-awaited WW-III.

Overall, oil is not much boosted like Gold as U.S. President Biden may not allow any real sanction on Iran, which may cause another spike in oil towards $100 just before the U.S. Presidential Election in Nov’24. Biden is already trailing Trump due to various domestic issues like the higher cost of living (elevated inflation-still around 20% higher than pre-COVID levels), a flood of immigration (legal/illegal), which is affecting well-paid employment opportunities for native Americans (as the migrant labor force is ready to do the same work with lesser pay).

Also, American Muslims or even most non-Muslim voters are not happy about the killing of innocent civilians including children by Israel in the same Gaza war, which is now looking more like genocide. Elsewhere, Putin may be also hatching various conspiracies to keep oil hotter above $100 ahead of Nov’24 election to ‘topple’ the un-friendly Biden government and bring the ‘trusted old friend’ Trump back to the White House for another term, so that Putin may be able to exit Ukraine war dilemma gracefully (face-saving exit).

Competitor China is also a big issue for US election/politicians; generally anti-China stance is a common thing ahead of the US election. Although Biden is less China-phobic than Trump, on Wednesday (17th April), Biden extended Trump's tariffs on Chinese metals, iron & steel, which was not taken by Wall Street in a positive/sporting spirit. Biden has also not withdrawn some portion of Trump tariffs on Chinese goods as the US treasury needs higher revenue (import duties) to bring down elevated borrowing costs on never-ending public debt, which is now hovering around 15% of core operating revenue, just around the redline for any AE.

Thus Trump tariff will continue for some additional revenue, irrespective of Democrats (Biden) and Republicans (Trump). On the other side, China allowed USDCNY above 7.00 to even 7.50 (average 7.25) to neutralize Trump tariff effects, while US consumers are also able to buy Chinese consumer goods at an almost affordable rate.

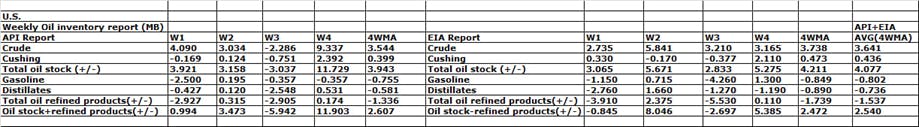

On Wednesday, the 4W moving average of API and EIA inventory data showed an overall buildup of oil + refined products around +2.540 MB; subsequently, oil slid on fading hopes of an early rebalancing.

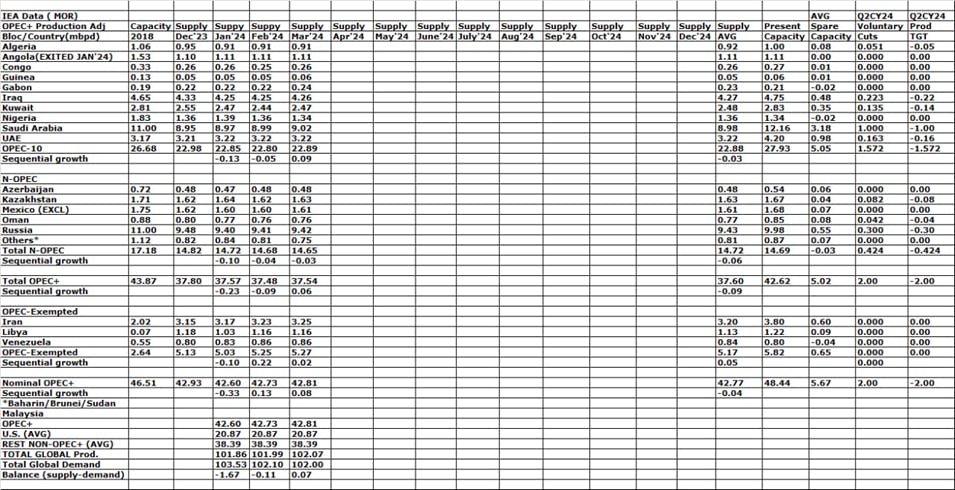

On 12th April, IEA published its April Monthly Oil Report (MOR):

· Non-OPEC+ oil output to rise +1.4 mbpd in 2025

· OPEC+ oil supply may fall by -0.820 mbpd in 2024 if cuts stay

· Global oil refinery runs to add +1 mbpd to 83.3 MB in 2024

· IEA cuts 2024 global oil refinery runs estimate by -0.160 mbpd

· Global oil output to rise by +0.770 mbpd to 102.9 mbpd in 2024

· IEA sees global oil demand at 103.2 mbpd in 2024 and 104.3 mbpd in 2025

· OPEC+ spare capacity could top 6 mbpd during 2025

· IEA cuts 2024 global oil demand growth estimate by about -0.130 mbpd

· Non-OPEC+ oil supply to expand by +1.6 mbpd in 2024

· Global oil refinery runs to add +0.830 mbpd to 84.2 MB in 2025

· IEA cites fading COVID rebound and EV fleet on slower demand growth

· Global oil supply to reach record 104.5 mbpd in 2025

Overall, the mix of EIA and OPEC production/demand data shows rebalancing is fading after Jan’24 and reaches equilibrium or even excess supply in Mar’24 as OPEC+ production cuts are being neutralized by higher productions from the U.S., Canada, Brazil, and Guyana.

Full text of IEA MOR-April’24

“World oil demand growth continues to lose momentum with 1Q24 growth of 1.6 mb/d, 120 kb/d below our previous forecast due to exceptionally weak OECD deliveries. With the post-Covid rebound now largely complete, and vehicle efficiencies and an expanding EV fleet acting as a further drag on oil demand, growth in 2024 and 2025 slows to 1.2 mb/d and 1.1 mb/d, respectively.

Non-OPEC+, led by the US, is set to drive world supply growth through 2025. For 2024, global output is forecast to rise by 770 kb/d to 102.9 mb/d. Non-OPEC+ production will expand by 1.6 mb/d, while OPEC+ supply could fall 820 kb/d if voluntary cuts remain in place. In 2025, global growth could rise to 1.6 mb/d. Non-OPEC+ is forecast to lead gains, rising 1.4 mb/d, while OPEC+ output could increase by 220 kb/d if curbs stay in place.

Global refinery throughputs are forecast to rise by 1 mb/d to 83.3 mb/d in 2024, 160 kb/d less than in last month’s Report, on lower Russian runs, unplanned outages in Europe, and still-tepid Chinese activity. Throughputs are projected to increase by 830 kb/d to 84.2 mb/d in 2025, as non-OECD growth of 1.1 mb/d more than offsets declines in the OECD.

Global observed oil inventories rose by 43.3 mb in February to a seven-month apex with oil on water at its highest level in 15 months. By contrast, on-land stocks fell to their lowest since at least 2016. OECD industry stocks decreased by 7.6 mb in February, remaining 65.1 mb below the five-year average. Early data indicate that they built 22 mb in March.

ICE Brent crude futures hit a six-month high of $90/bbl in early April amid escalating tensions in the Middle East, attacks on Russian refineries, and an extension of OPEC+ output cuts through June. Crude’s price strength was underpinned by bullish investor sentiment, with exchange net fund positions in Brent rising to their highest in a year

Increased spare

Benchmark crude oil prices continued their upward trajectory in March and early April, as heightened geopolitical tensions coincided with the prospect of a tighter supply-demand balance through the remainder of the year. Brent crude futures breached the symbolic $90/bbl threshold on 5 April, up nearly $8/bbl from early March, reaching the highest level since October 2023, amid heightened tensions between Israel and Iran. Russian refinery outages added to product market unease, while OPEC+ put pressure on some countries to increase compliance with agreed voluntary production cuts through 2Q24.

Escalating oil supply security concerns are set against a backdrop of solid global oil demand growth of 1.6 mb/d in the first quarter and a more upbeat outlook for the global economy. World oil demand growth has nevertheless been revised down by roughly 100 kb/d since last month’s Report, to 1.2 mb/d, following exceptionally weak deliveries in the OECD at the start of the year.

Our newly-released 2025 forecast in this month’s Report shows the pace of expansion will decelerate further, to 1.1 mb/d next year as the post-Covid 19 rebound has run its course. Non-OECD countries dominate the outlook, with forecast demand set to increase by 1.3 mb/d in 2024 and 1.2 mb/d in 2025. By contrast, consumption in the OECD will decline by 60 kb/d in both years. China continues to lead the growth even as its share of the global increase slumps from 79% in 2023 to 45% in 2024 and 27% next year.

Sustained output curbs by the OPEC+ alliance mean that non-OPEC+ producers, led by the Americas, will continue to drive world oil supply growth through 2025. OPEC+ market share has already slipped to all-time lows after the alliance removed close to 2 mb/d of supply from the market since the end of 2022, while non-OPEC+ ramped up by nearly the same amount. That trend looks set to continue in 2024 when non-OPEC+ boosts output by a further 1.6 mb/d. OPEC+ supply is projected to fall by 820 kb/d, provided cuts are maintained through the second half of the year. In 2025, global oil supply is forecast to increase by 1.6 mb/d to a new record of 104.5 mb/d, as non-OPEC+ lead gains for a third straight year, rising by 1.4 mb/d.

For context, the additional volumes from the United States, Brazil, Guyana, and Canada alone could come close to meeting world oil demand growth for this year and next. These four countries are set to once again produce at record highs, adding a combined 1.2 mb/d in 2024 and 1 mb/d in 2025. Although momentum slows in the United States, it still ranks as the world’s largest source of supply growth in 2024 and 2025, adding 650 kb/d and 540 kb/d, respectively.

Robust production from non-OPEC+ coupled with a projected slowdown in demand growth will lower the call on OPEC+ crude by roughly 300 kb/d in 2025, to an average of 41.5 mb/d. If the bloc were to produce in line with that call, effective spare capacity could top 6 mb/d – excluding the Covid-19 period – its largest ever supply buffer.

Highlights of OPEC MOR-April’24:

· OPEC Oil Production Inched Higher in March

· Crude oil output in March rose by +0.30 mbpd to 26.60 mbpd

· OPEC keeps 2025 US economic growth forecast at 1.7%

· The robust oil demand outlook for the summer months warrants careful market monitoring amid ongoing uncertainties to ensure a sound and sustainable market balance

· Iran Crude output rose by +0.28 mbpd in March to 3.19 mbpd -Secondary Sources

· OPEC leaves 2024 world Oil demand growth forecast unchanged at +2.25 mbpd

· OPEC leaves 2025 world oil demand growth forecast unchanged at +1.85 mbpd

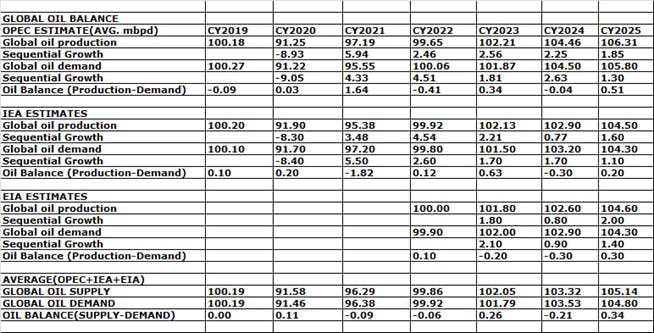

Overall, if we take an average of OPEC+IEA+EIA data, there was some glut around +0.26 mbpd (more supplies than demand) in 2023, whereas there may be some rebalancing (lower supply than demand) of -0.21 mbpd projected in 2024.

Overall, global production/supply was higher than demand in Mar’24 sequentially, while OPEC+ production was also +0.08 mbpd higher. But lingering oil movement disruptions in the Red Sea, Iran-Israel and Russia-Ukraine geopolitical tensions, and hopes & hypes of higher demand from China and India (election season-higher demand for petrol/diesel for political campaigning) boosted oil.

OPEC+ production cut narrative is now sounding more like central bank jawboning rather than real action/cut as apart from Saudi Arabia, none of the OPEC+ producers have meaningful real effective spare capacity to influence the global supply. Also, Saudi Arabia has some limits as oil revenue is the main source of national income. The same is almost true for other big OPEC+ producers. Moreover, OPEC+ is steadily losing market share as N-OPEC+ led by the US is increasing their production levels to nullify the OPEC+ cartel in this war of sheikhs and shale.

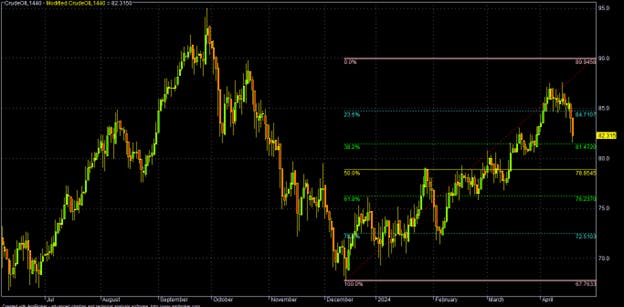

Technical trading levels: Oil

Technically Oil (82.20) now has to sustain over 81.00 for any recovery to 85.00/88.00-90.00/91.00-95.00; otherwise sustaining below 80.50, oil may again fall to 79.50/76.50*-75.20/73.00 and 72.00-70.00 in the coming days.

The materials contained on this document are not made by iFOREX but by an independent third party and should not in any way be construed, either explicitly or implicitly, directly or indirectly, as investment advice, recommendation or suggestion of an investment strategy with respect to a financial instrument, in any manner whatsoever. Any indication of past performance or simulated past performance included in this document is not a reliable indicator of future results. For the full disclaimer click here.

Join iFOREX to get an education package and start taking advantage of market opportunities.